Treasury prices are rising and stocks are off this morning on lower Retail Sales numbers. The 10 year Treasury had traded as high as 3.30% recently and is now being driven down below the 3.10% level.

I read a story on Bloomberg this morning stating that the low retail sales number was a surprise. I look around the office and I don’t see anyone here surprised by it. Consumers aren’t having the best time lately. Initial Jobless claims is posting over 600,000 per week for 14 straight weeks, credit card rates for many borrowers are pushing 30%, credit card limits have been cut, home equity lines have gone away, the survey predicts unemployment to continue rising, and Americans on average have had an abysmal savings rate over the last few years. I’m all for big screen TV’s but where are the consumers going to get the money to spend?

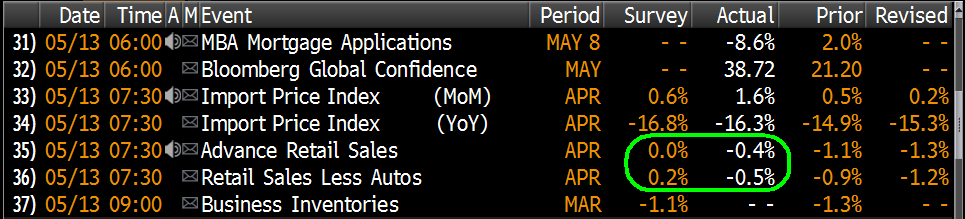

This morning’s economic releases are below. I’ve highlighted the Retail Sales numbers that are moving the market this morning.

Anecdotal Evidence

Car dealer commercials provide a nice bit of anecdotal evidence as to the state of consumer spending. I hear them all the time on the radio while I’m driving in to work and every now and then they broadcast one that gives me a very clear signal as to the health of the economy.

Before the meltdown really began back in 2007 I heard the car-guy on the radio using his big car-dealer-radio-voice and he says/shouts “I’m thinking of a three digit number that doesn’t matter….IT’S YOUR CREDIT SCORE!!!” That commercial highlighted for me the prevailing state of risk management in some segments of our economy at the time. At that moment I laughed out loud at the thought of the poor folks that had been buying securitized auto loans. If I owned Asset Backed Securities and I heard that commercial I might have wrecked my truck.

Fast forward to May 2009. The most recent ad that gives me a clear indication as to the state of the consumer is the plan where the dealer will take your car back from you at no cost if you lose your job. This is different than the regular way they take your car back after a job loss…that being by repossession…this one is better. In the current economy people are actually starting to do the rational thing…they are saving more which by definition means they will spend less. This means dealers will sell fewer cars. BUT dealers have come up with a way to allay your concerns about job loss. If you buy a car today they are offering to take it back from you with no penalty if you lose your job. Who could argue with that right?

Well I’ve got a few minutes to think about that deal as I drive to work. I think that the conceptual basis of the ad misses a lot of consumers. In fact this has the potential to morph into one of those classic studies on the rationality of consumers. This ad essentially boils down to telling an over-leveraged consumer that is concerned about catastrophic job loss that the best course of action is to leverage up even more. After all what could possibly go wrong? We’ll take the car back. Never mind the pile of cash you could have had in the bank as a backstop in case you lose the job. In the car companies plan I guess you can live on the memories of the Hyundai they took back from you. The alternate ad slogan could be “We’ll make sure you lose your job and your car at the same time.”

I hope the American consumer doesn’t take that bait. I hope that this episode in our financial history is one that pushes people back toward financial responsibility, and I hope that the retail sales numbers are a sign that maybe that is occurring. A seismic shift like this has to have some pain…consumers have a mountain of debt to pay off. Every dollar put toward debt reduction is a dollar that can’t be used for consumption…in fact that dollar was already used for consumption and is just now being used to fill in the hole.

The shape of the consumer

I’ve attached two graphs that I think help to paint a picture of the situation faced by the consumer right now. The first graph below shows the growth in Total Consumer Credit from 1980 to this month (excluding loans secured by Real Estate). This has become a mountain over time. We have just recently seen a turning point in the ever increasing slope of this line.

The graph below shows the national savings rate as measured by percentage of disposable income saved. You can see that in prior time periods Americans saved more in general.

You can see that savings rates between 6% and 10% were fairly common during the 1980’s. The trend beginning in the 1990’s was that savings rates dropped. In fact they kept dropping to the point where the savings rate on average went negative…that’s a pretty aggressive use of credit, but hey when times are good there is nothing to fear right?

I’ve written in the past that I would expect this savings rate to begin moving back up. Fear is a very strong motivator. I would expect some continued improvement in this metric. The graphs we just covered (total debt and personal savings) paint a picture of a consumer with his back against the wall. He’s got a mountain of debt sitting on him, increased odds of losing his job, no cash to fall back on, and car dealers trying to take what little discretionary cash flow he’s got left. It’s tough to picture a sustained rally in Retail Sales when there is so much work to be done paying off debt and building savings.

I’m certain that there are some consumers hoping for the government to ride in on its spending horse and save the day. It would appear that those consumers are between Barack and a hard place.

If you have any questions or if there is anything I can be doing for you just let me know.

No comments:

Post a Comment