The definition of “good news” has apparently changed

There is a lot of talk going on in the news about how much better things are looking for th economy. It doesn't FEEL like alot of good news based on the conversations I'm having with bankers around the country every day; but just to make sure I looked up the meaning of "good news" on the off chance that I was missing something.

This is the meaning of "good news" from the dictionary: -noun, informal

"someone or someting that is positive, encouraging, uplifting, desirable, or the like."

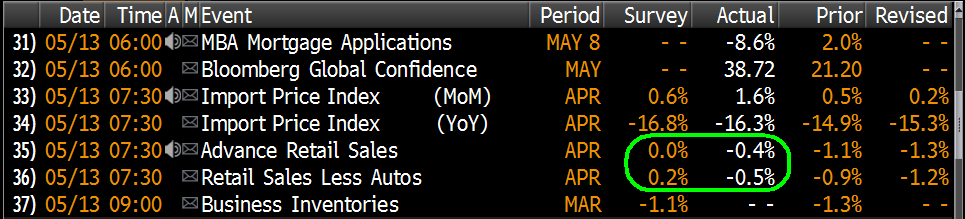

Despite what is being written in the news I can’t classify much of the recent news as positive, encouraging, uplifting, or desirable. LESS BAD I can label it…but good news is a stretch.

The “good” and the “less bad”

We’ve got Initial Jobless Claims that are beginning to ebb but still running well north of 600,000 per week. In the last few weeks we’ve seen factory orders falling, personal income figures lower than the estimates, and durable goods orders lower than expected. There are still huge amounts of debt on personal balance sheets, massive government spending that I would expect to be a drag on future growth prospects, several icons of American manufacturing prowess that are on their deathbeds, and the government is still deeply entrenched in the private sector with no talk of getting out. I think I’m more of a realist than a pessimist…it’s just that reality at the moment happens to look bad.

This morning’s big releases were Initial Jobless Claims and Continuing Claims. Initial Jobless Claims came out below the estimate, posting 601,000 vs. an estimate of 635,000. This is the 14th consecutive week that the economy has shed over 600,000 jobs.

Continuing Claims show that 6.35 million people are currently drawing unemployment benefits. Bloomberg provides data going back to 1968 on continuing claims. The chart below shows the trend in Continuing Claims from 1968 to last month. You can see that we are clearly in record territory in terms of the NUMBER of Americans collecting unemployment benefits. Keep in mind that the unemployment RATE may not be at a record level because the size of the workforce in 2009 is larger than that of previous cycles. For example last month’s 8.5% unemployment rate applied to today’s work force of over 150 million people will mathematically put more people on the Continuing Claims rolls than the same rate applied to the 1900 labor force which was around 20 million people.

One of the more interesting bits of “good news” was Consumer Confidence. It was up. In the current environment it is tempting to completely ignore consumer confidence. Rising consumer confidence in this market doesn’t compute. These are the same consumers on average that carry large credit card balances with skyrocketing rates, can’t get a loan, are losing their jobs, and whose homes have lost almost 20% of their value over the last year. If these people are confident, I’m not sure they understand what’s really going on.

Some of the news actually is good news. One such story has been the reduction of inter-bank borrowing costs as measured by Libor. This is a very good sign that the fear in the credit markets is beginning to wane. Capital flows in the market are like oil in the economic engine. Without proper flow the engine will seize up. This is a legitimate good news story.

What’s the shape of a recovery?

We all want economic recovery. We want jobless rates down, productivity up, and increasing stock prices that reflect a strong and vibrant future for the health of our economy as a whole. Despite some “less bad” numbers, it would appear that we are a long way from that reality.

With regard to economic recovery you generally hear the talk in terms of the “shape” of the recovery. There is the “V” shaped recovery where GDP drops sharply then rebounds off the bottom just as sharply to form a “V” shape in a chart. There is a “U” shaped recovery where you drop, travel sideways for a bit and then pop up. Finally there is the “L” shaped “recovery” where you hit the deck and just travel sideways with no material growth for quite some time.

Gimme an example

An airplane in flight provides a nice analogy for the shape of economic recoveries. Under normal circumstances an airplane is going to take off and follow a gentle slope of increasing altitude. We’re all familiar with this right? All of the passengers are moving in the same direction, they are calm, happy, and thinking about their destination (ultimately retirement in the case of the economy). Upon reaching its target altitude the plane will just cruise along at a comfortable pace. The economy growing with roughly 4.00% annual GDP growth is akin to an airplane mid-flight when all is well and everyone is happy. The seat belt sign is turned off, you are free to move about the cabin, and you get free pretzels.

A recession is like losing one engine…some lights are going off in the cockpit, some radio calls are made, and priorities are shifted around to accommodate the situation. In this stage the seat belt sign is lit, you need to stay in your seat, they put the drink cart away, passengers become concerned but nobody is freaking out. After all, these pilots are professionals it should all work out OK...right? It’s a bit disconcerting but ultimately the plane lands, gets fixed quickly, and gets back to altitude. Think of this as the “V” shaped recession.

A bad recession is like losing all engine power and stalling (definition of a Stall - an instance or the condition of causing an airplane to fly at an angle of attack greater than the angle of maximum lift, causing loss of control and a downward spin). The flight path takes a decidedly negative turn, begins a steep dive, and the pilot can’t tell you if you’re going in nose-first, or if he’ll be able to restore power and pull out of it. The passengers are no longer calm…in fact I’d like you to picture the scene from the movie Airplane when the stewardess tells the passengers that they are out of coffee. The passengers are in full freak-out mode at this point, some are even smoking in the lavatory despite the fact that it’s a violation of federal law (think initial jobless claims over 600,000 for 8 weeks in a row, home prices falling nationwide, a potential run on banks nationwide, big well known companies going bankrupt, and massive government interference in the free markets). People are praying that the pilots know what they’re doing but many are beginning to have serious doubts about the outcome of this flight. Ultimately the pilot gets one engine going….and after a good scare the plane lands, you spend a few days to a week at the airport, things get fixed, and you get back to altitude. Think of this as the “U” shaped recession.

Another possible outcome of the bad recession is where the pilot manages to keep the plane from drilling a hole in the earth with the nose cone, and instead is able to pull out of the dive juuuuuuussssst enough to glide in on the belly of the plane…hitting a lot of things along the way, banging everyone up, and losing some luggage, but ultimately everyone survives. This is the “L” shaped recovery. At this point you can de-plane, look back across the trail of smoking debris leading up the aircraft, and you begin to figure out how to get this thing back in the air.

The difference between a bad recession and a depression is whether or not the plane can pull out of the dive…we’ll skip the depression landing.

Which recovery will we get?

Assuming we only use these three possible scenarios I think it is possible to discount a “V” shaped recovery. I see nothing in the data that points to a rapid recovery, and I can’t find anyone that thinks we’re just going to bounce off the bottom and get right back to normal. There are far too many problems in my opinion to allow that to happen.

If it’s a “U” I hope we land in a place that’s at least tolerable until we can get back in the air. And if it’s an “L” I might spend my retirement living with my kids. I’ll have to keep that in mind as I assign chores over these next few years. It might be in my best interest to have their mother assign the tough ones and I’ll give out the easy stuff…winning hearts and minds.

Some real good news

Many banks are stepping into the markets to raise new capital…and doing so quite successfully. I spoke with a bank yesterday who raised $60 million in a stock issuance that was four-times over-subscribed. That is not only a sign of a strong bank, but of a system that is no longer paralyzed with fear.

If you have any questions on this material or if there is anything I can be doing for you just let me know.